Notice to RSMIN Citizens,

This page is intended to help clarify what rights and privileges are available to RSMIN Citizens, and the process of utilizing those rights.

This page will be updated as Rights, Privileges or Processes change.

Introduction

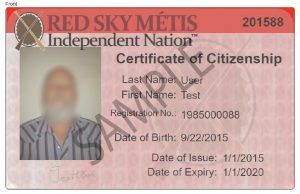

If you have been issued a new Plastic RSMIN Identification Card you have been registered in the RSMIN Citizenship registry.

Old laminated cards are invalid and have been replaced with the new cards in 2015.

Please return old cards to the RSMIN Office.

RSMIN Criteria for registry is limited to individuals that have proven they are descended from the historic Métis Community in the Robinson Superior Treaty area at the time of the Treaty in the year 1850. For more information regarding applying for citizenship please see rsmin.ca/citizenship page.

RSMIN is actively working to ensure the new RSMIN Cards are recognized by Institutions and Government Agencies as Rights, Privileges, and Opportunities are being established.

Individuals that meet RSMIN citizenship criteria are Métis People of Canada, belonging to a historic Métis Community meeting the criteria established by R. vs Powley and described by the Canadian Constitution Section 35.

As Aboriginal People of Canada, RSMIN Citizens are entitled to those rights and privileges that flow from the Section 35 of the Canadian Constitution, Aboriginal / Métis Rights. These rights are still relatively new and all of the grey areas have yet to be defined.

The process of considering the complex and precedent setting case that would recognize RSMIN Citizens as having RST1850 Treaty Rights and or other potential Rights is ongoing and will require time to complete.

Aboriginal Opportunities

An RSMIN Citizen is an aboriginal person of Canada and may qualify for bursaries, education or other opportunities for Métis / Aboriginal People. These opportunities are each subject to a unique application process that may require other prerequisite or qualifiers. Opportunities are subject to an approval process and do not guarantee funding or participation.

Some categories where opportunities may be available are:

- Aboriginal Education and Training

- Aboriginal Employment and Business Opportunities

- Aboriginal Housing

- Aboriginal Business

- Other Aboriginal Programs / Opportunities

If you are interested in pursuing an aboriginal opportunity

First step is to get information about the program you are interested in. You may need to contact the administrator of that program or opportunity to find out more information regarding participation criteria. If you feel you qualify and are ready, apply.

If you or the opportunity administrator has any questions regarding your aboriginal status or the RSMIN community please contact the RSMIN office at (807 623 4635), or email opportunities@rsmin.ca.

Please check the www.RSMIN.ca website for updates and posting regarding potential opportunities.

Border Crossing

Border crossing is a matter of national security and is considered with extreme caution; this is not only a policy of Canada but also a bilateral understanding between two countries.

The Jay Treaty of 1794 provided free border-crossing rights for “the Indians dwelling on either side of the boundary line” between Upper and Lower Canada and the United States, and exemption from duty or taxes on their “own proper goods” when crossing the border.

After the War of 1812, the Treaty of Ghent between Britain and the United States was intended to restore the border-crossing rights of the Jay Treaty, however legislation implementing these rights in Upper and Lower Canada lapsed at that time. Because of this, the Jay Treaty is not recognized in-Canada and by the Canadian Government. There is therefore no link between the new Secure Certificate of Indian Status and the Jay Treaty.

In the 1920s, the United States changed its immigration laws and ever since, Canadian-born people with at least 50 per cent Aboriginal blood can enter, live in and work in the United States without immigration restrictions.

At this time RSMIN Citizens are not eligible to cross the US – Canadian border as Status Indians.

For more information please follow the below links:

https://www.aadnc-aandc.gc.ca/eng/1100100032399/1100100032400

Harvesting

While some interim measure have been established there has been no standards set for Métis Harvesting in Ontario. RSMIN is in the process of developing the RSMIN Harvesting Policy. This policy will establish the foundation of sustainable traditional harvesting for RSMIN Citizens.

At this time the RMSIN council recommends that citizens follow the Ontario standards for harvesting until the RSMIN Harvesting Policy has been formally implemented. As more information regarding Harvesting becomes available this page will be updated.

Powley

For more information please follow the below links

https://www.rcaanc-cirnac.gc.ca/eng/1100100014413/1535468629182

Tax Exempt Status at Point of Sale

Aboriginal / Indigenous people are subject to the same tax rules as other Canadian residents unless their income is eligible for the tax exemption under section 87 of the Indian Act.

RSMIN Citizens are not eligible at this time for tax exceptions that flow from the Indian Act.

For more information please visit the following links:

http://www.fin.gov.on.ca/en/guides/hst/80.html

http://www.fin.gov.on.ca/en/taxtips/rst/02.html

Video

http://www.cra-arc.gc.ca/vdgllry/bsnss/menu-eng.html?clp=nwsrm/vdcsts/2011/v110414-1-eng&fmt=mp4

Gas Card (Certificate of Exemption)

Starting January 1, 2020, the Ontario Gas Card will be discontinued. Instead, First Nation individuals will use their federally issued Certificate of Indian Status (Status Card) to purchase tax-exempt gasoline on reserve. Bands, Tribal Councils and band-empowered entities will use an exemption certificate issued by the Ministry of Finance.

RSMIN Citizens are not eligible at this time for tax exceptions on gas.

https://www.ontario.ca/page/first-nation-purchases-tax-exempt-gas